In the domain of digital transaction mechanisms, there’s a significant push towards optimizing interoperability between end-users and purchasers and the progression in this sector underscores the imperative of engineering and advanced methodology for payment facilitation.This entails a unique technology where a service provider interacts with a user, garnering predefined information. This information collection is intrinsically linked to the digital valuation of the user’s data. The subsequent payment process is then based on the transactional worth of this data, ensuring a precise, digital transactional value.

Technological Context

This technology focuses on enabling digital transactions over either conventional banking networks or innovative blockchain-enabled ones. The arena of digital transactions, while vast, is rooted in the necessity for ease and security when multiple parties interact within a service ecosystem.

The Existing Paradigm

The current service ecosystem comprises multiple parties, each playing a pivotal role in buying and delivering services. These interactions depend upon payment transactions – a critical focal point for both service providers and buyers. Traditional financial instruments, such as cash and credit, still dominate the bulk of these exchanges. This reliance gives rise to an intense competitive environment among service providers to pioneer novel ways of facilitating payments.

The emergence of cryptocurrencies like bitcoin has spotlighted as potential alternatives. These digital currencies offer unique benefits but are not without their limitations. As a consequence, while they present a stride towards more ubiquitous transaction methods, they don’t fully address all the existing challenges.

Identifying the Gap

There’s an evident requirement for a novel mode of payment to which the ideal solution should not only encapsulate security and enhanced dynamics but also empower the individual making the purchase within the service ecosystem. The aspiration is to build a payment methodology that transcends the constraints of traditional means and the limitations inherent to current digital currencies.

The continual change in the digital transaction space prompts the need for innovations that are more secure, dynamic, and individual-centric. As the quest continues, technologies that address these nuanced challenges are paramount to shaping the future of digital payments.

Functional Capabilities of the Cloud-Based Payment System

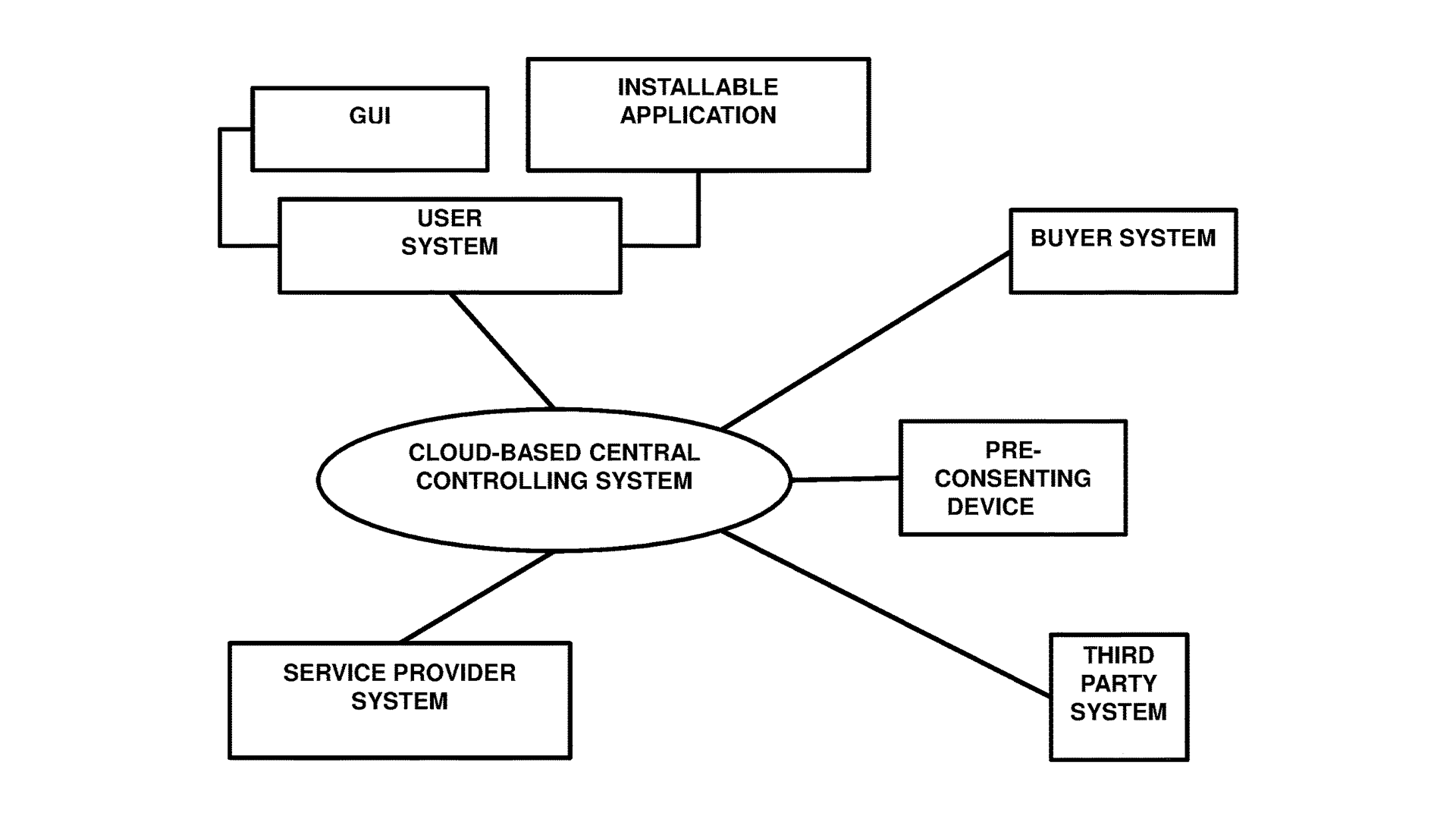

Centralized Control in the Cloud

The essence of this digital payment technology is anchored in its central controlling entity, which is cloud-based. This pivotal hub, known as the “Cloud-based payment system,” plays multiple vital roles. It serves as a repository for computer executable files that carry structured user data. Furthermore, this central entity is adept at collecting and authenticating authorization codes, which is instrumental in upholding the authenticity of each digital transaction. A standout feature is its prowess in extracting structured data from computer files. In addition, it is equipped with a data worth valuation mechanism that meticulously evaluates the transactional value of the user’s data.

Service Provider Interaction

The service provider inherently extends services, contingent on receiving a payment and the user’s consent to access their data. Of particular significance is the technology’s ability to initiate requests for data usage consents and, in the subsequent stages, to appraise the transactional worth of the user’s data.

User Interface & Engagement

The user’s interaction with this technology is channeled through a dedicated subsystem. Central to this interaction is an application tailored for gleaning data from the user. Complementing this is a graphical user interface (GUI) which paves the way for users to authorize the service provider to access their data, thereby nurturing a foundation of trust and clarity.

The Buyer’s Role

The architecture of the buyer’s subsystem is crafted to ensure it doesn’t engage in a direct data exchange with the service provider. Its core function hinges on establishing specific protocols laden with predefined criteria and preferences. These protocols are instrumental in guiding the cloud-based system when gauging the transactional value of user data.

Involvement of Third-Party Entities

The technology seamlessly incorporates a third-party subsystem and its primary responsibility is to augment the service provider subsystem’s efforts in discerning the transactional worth of user data, thereby introducing an added layer of scrutiny.

Pre-Consent for Enhanced Security

A salient component of this technology is the pre-consenting subsystem. Distinctly situated away from the user subsystem, its primary role revolves around processing digital signals emanating from the user system. This in turn empowers the service provider subsystem with the mandate to share user data with the buyer subsystem, making way for efficient and fortified digital purchases.

Payment Processing

The culmination of this technology’s capabilities is manifested in the payment engine, referred to as the cloud-based payment system. With a seamless integration to the cloud-based central entity, it boasts an array of functionalities. These include sophisticated digital payment processing techniques grounded on the transactional value of shared user data. Furthermore, the engine employs a nuanced payment calculation methodology encompassing service charges for digital services rendered, co-payment negotiations between users and third parties, and estimations of the transactional value of shared user data..

In essence, this digital payment technology is a tapestry of intricate functionalities and capabilities, setting a gold standard for seamless, transparent, and fortified transactions in the digital domain.