With the currently evolving Digital Landscape, digital payment methods seeing profound shifts and with the integration of technologies and conventional banking systems, the digital payment domain has been under consistent metamorphosis. However, the main challenge remains in integrating such innovations while ensuring security and ease for the user.

The Prevailing Challenge with the Technology

Within the expansive domain of service ecosystems, transactions materialize between the service buyer and the service provider, central to which is the pivotal act of payment. Despite advancements, a significant portion of these transactions remains anchored to antiquated financial instruments, namely cash and credits. Even as service providers endeavor to adopt more contemporary modes like cryptocurrencies, these alternative currencies present their own set of advantages and challenges.

Traditional Financial Instruments

Despite the digital revolution, a considerable chunk of payments is executed through classic means like cash and credits. The inherent limitations of these methods often obstruct the fluidity and seamlessness of transactions.

The Pinnacle of Solution: Harnessing Data Worth

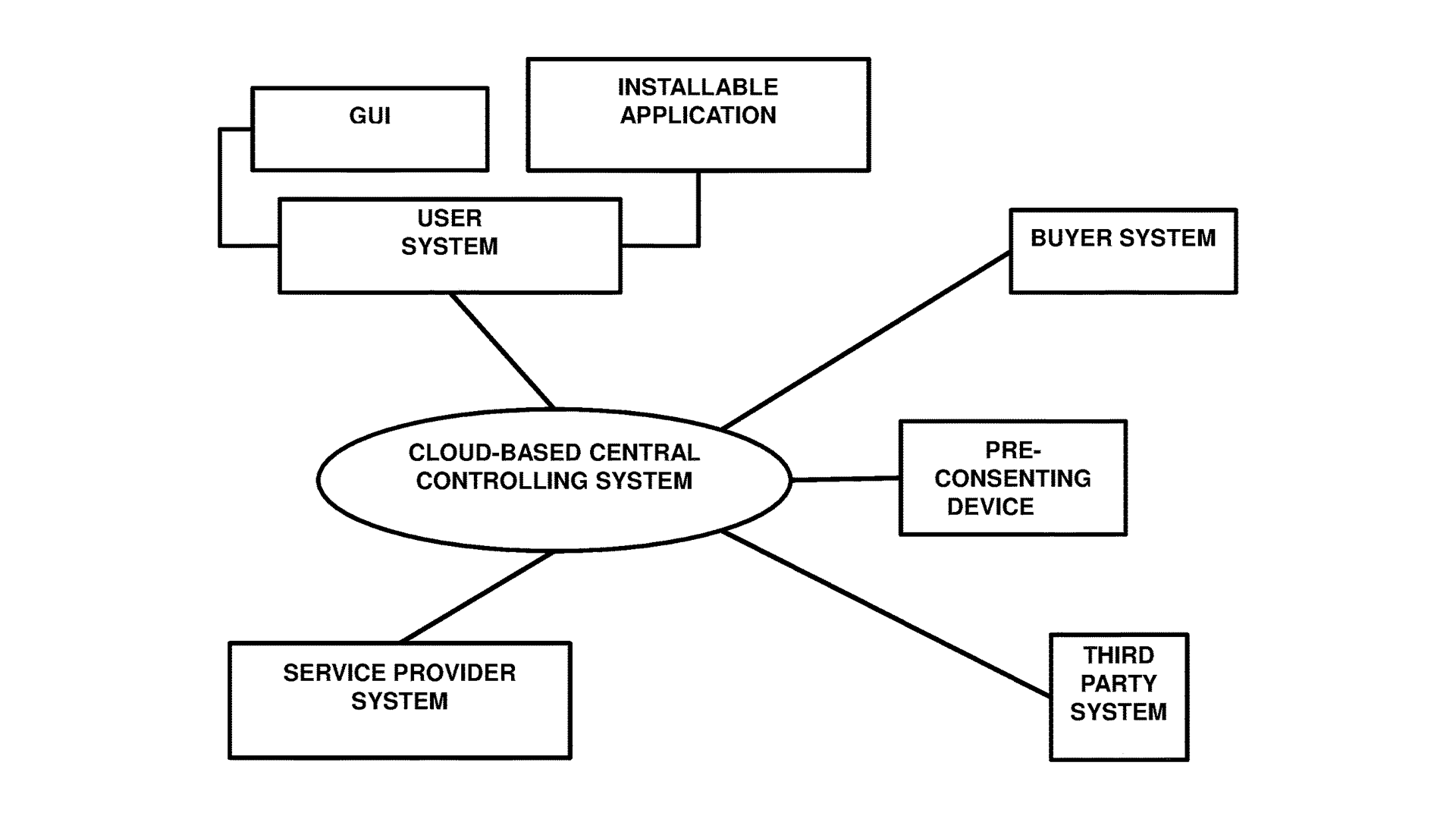

To address the existing challenges and to transcend the limitations of the current payment mediums, the described technology hinges on the unique concept of ‘data worth’. It emphasizes:

Service Interaction Component

This component is adept at gathering predefined details about the user and the user’s platform. The emphasis is not just on transaction details but also on the inherent worth of data owned by the user.

Digital Transactional Value Computation for Seamless Transactions

Central to this technology is a payment engine that operates on the principle of determining the digital transactional value. This value, which is reflective of the data worth tied to the user’s data and which has been greenlit for sharing, forms the basis for the digital payment.

User Consent Mechanism

“A foundational aspect of this technology is the user’s autonomy, ensuring seamless transactions. A pre-consenting mechanism is integrated, ensuring the user has full control over what data is shared and its consequent transactional value.

The presented technology addresses the pressing need for a more dynamic, secure, and enhanced digital payment mode with a focus on seamless transactions. Rooted in the potential of data worth and user consent, it promises a redefined experience for users in the service ecosystem, ensuring transactions are not just digital but also intrinsically valuable.”

Service Interaction and Communication

The interaction and communication among the participants actively gathers specific user-related data. This collected data predominantly includes identifiers for the user and their platform and the specifics about the service they are seeking.

Comprehensive Payment Computation

The Payment Computation capabilities of the technology majorly revolve around three functionalities:

Service Charge Calculation

The first digital transactional value represents the cost for the digitally provided service.

Co-payment Factor

It also takes into account the second digital transactional value, indicative of any predefined co-payment arrangements between the user and a third party.

Data Worth Estimation

The most innovative function is the computation of the third digital transactional value, rooted in the ‘data worth’ principle. The technology assigns value to the user’s authorized data, with this value being assessed based on criteria provided by the buying entity. This criteria consider various data types, entities, and attributes.

Inventors referred their above patented mechanism as ‘Pay Per Data’, which means the more worth the data has, the more services one can avail.

User Autonomy and Data Consent

Central to ensuring user trust and agency in this technology is the ability to provide pre-consent, which is located at a distance from the user platform, its key functionalities include:

Receiving Authorization Signals

This system is attuned to receiving digital indications, authorizing the sharing of user’s data. The user’s data, in this context, is not just mere information but holds transactional value for digital purchases.

Initiation of Data Sharing Trigger

Upon receiving the above consent, the system activates a trigger. This trigger contains a distinctive code linked to the user, their platform, and the specific data they’ve permitted for sharing. This mechanism ensures the seamless yet controlled sharing, processing, and storage of user data.

In essence, this advanced digital payment technology intermingles with user-centric functionalities with data monetization. By enabling seamless communication, comprehensive payment computation, and ensuring user data autonomy, the technology paves the way for a more nuanced and efficient digital transaction landscape.